Sunday, October 07, 2007

SAP to Acquire Business Objects in Friendly Takeover; Combined Companies to Accelerate Leadership for Business User Applications

Sunday October 7, 3:52 pm ET

SAP and Business Objects to offer the industry's most comprehensive portfolio of business performance and optimization solutions for Business Users for companies of all sizes

WALLDORF, Germany and PARIS, Oct. 7 /PRNewswire-FirstCall/ -- SAP AG (NYSE: SAP - News) and Business Objects S.A. (Nasdaq: BOBJ - News; Euronext Paris ISIN code: FR0004026250 - BOB) today announced that the companies have reached an agreement that will bring together two of the information technology industry's leaders, resulting in an unmatched offering for Business Users, enabling timely and accurate decision-making. Under the terms and conditions of the tender offer agreement, SAP will make a cash offer of euro 42.00 per ordinary share and for American Depositary Shares (ADS) at the US$ equivalent based on the EUR/US$ exchange rate as of the settlement of the tender offers. The transaction volume taking into account the transaction costs will be slightly above euro 4.8 billion. The Business Objects board of directors has approved the tender offer agreement between the two companies and anticipates recommending the offer to its shareholders subject to fulfillment of certain regulatory requirements.

Together, SAP and Business Objects intend to offer high-value solutions for process- and business-oriented professionals. The solutions will be designed to enable companies to strengthen decision processes, increase customer value and create sustainable competitive advantage through real-time, multi-dimensional business intelligence. SAP and Business Objects believe that customers will gain significant business benefits through the combination of new, innovative offerings of enterprise-wide business intelligence solutions along with embedded analytics in transactional applications. Additionally, the joint partner ecosystems will be fueled by the industry's most powerful business process platform providing customers with the best enterprise information management platform available for SAP and non-SAP environments.

SAP is the world's leading provider of business software with more than 41,200 customers in more than 120 countries running SAP applications-from distinct solutions addressing the needs of small and midsize enterprises to suite offerings for global organizations. A key component of SAP's growth strategy is to significantly increase its revenues from new products including addressing the growing demands of Business Users.

"We are highly committed to the next generation of applications serving Business Users," said Henning Kagermann, CEO of SAP AG. "The combination of SAP and Business Objects in their respective domains will benefit customers, prospects, partners, employees and shareholders. At SAP, we are excited about the prospect of having Business Objects join the SAP Group."

"The acquisition of Business Objects is in keeping with SAP's stated strategy to double our addressable market by 2010 as announced in 2005," said Kagermann. "SAP will accelerate its growth in the Business User segment, while complementing the company's successful organic growth strategy. With the delivery of the first business process platform; the rapid adoption of our enterprise SOA platform, SAP NetWeaver; and the successful launch of the first complete on-demand business solution for midsized companies, SAP Business ByDesign, SAP can now take the opportunity to focus on the industry's next high-growth opportunity, by accelerating and enhancing our efforts for the Business User category," Kagermann, said.

Headquartered in Paris, France Business Objects is widely recognized as the pioneer of the business intelligence (BI) software category. Today, Business Objects is the world's leading BI software company with solutions spanning the information discovery and delivery, information management, analysis and performance management categories for more than 44,000 customers around the globe.

"Business Objects helps companies transform the way they work through the use of intelligent information," said Bernard Liautaud, Chairman and Founder of Business Objects. "The combination of Business Objects and SAP means that we can truly amplify the reach of Business Intelligence -- from the C-suite to Main Street. John Schwarz and I are excited to see the innovation and hard work of our employees and partners validated and soon extended by the portfolio, domain expertise and presence of SAP."

Transaction expected to be accretive to SAP's earnings per share on a U.S. GAAP basis in 2009 and beyond

SAP and Business Objects plan to exploit additional revenue opportunities and leverage potential synergies. Additional details regarding specific product, go-to-market and other executional details will be provided after the transaction is complete. Neither company intends to undertake significant restructuring as a result of the transaction.

The closing of the transaction is expected within the first quarter of 2008. On that basis SAP expects the transaction to be accretive to SAP's earnings per share on a U.S. GAAP basis in 2009 and beyond; however, due to acquisition-related one-time effects in 2008 SAP expects the transaction to be dilutive by mid single digits euro cents to SAP's 2008 earnings per share on a U.S. GAAP basis.

Business Objects to Operate Stand-Alone; Companies to Share Executives, Resources

The two companies announced that Business Objects will operate as a stand- alone business as part of the SAP Group. Business Objects customers will continue to benefit from open, broad and integrated business intelligence solutions -- independent of databases and applications - while also gaining the advantage of application alignment for business analytics. Business Objects will significantly enhance its Business Intelligence portfolio scope and capacity with SAP people, know-how and networks.

SAP said that the expertise and solutions from Business Objects would be complimentary to offerings SAP already provides for Business Users -- including, for example, category leadership in Governance, Risk and Compliance; business intelligence in the SAP platform; as well as corporate performance management capabilities - including those recently added through tuck-in acquisitions from OutlookSoft and Pilot Software.

When the transaction is complete, John Schwarz will continue as the CEO of the Business Objects entity and is expected to become a member of the SAP Executive Board. Doug Merritt, Corporate Officer, Business User, SAP, will then join the Business Objects entity and report to John Schwarz. Subject to the closing, SAP's Supervisory Board intends to propose to elect Business Object founder Bernard Liautaud to the SAP Supervisory board at the company's next shareholders meeting. Until that time, Liautaud will have an advisory role to Henning Kagermann on aspects of strategy and integration.

Tender Offer Details and Disclosure Information

The transaction is to take the form of a tender offer under French law and a parallel tender offer under US law for all Business Objects shares and all American Depositary Shares representing Business Objects ordinary shares (the "ADS"), as well as all convertible bonds issued by Business Objects (the "Convertible Bonds") and all warrants issued by Business Objects (the "Warrants"). The price to be offered per convertible bond will be euro 50.65. Under the terms and conditions of the tender offer agreement, SAP will make a cash offer of euro 42.00 per ordinary share and for American Depositary Shares (ADS) at the US$ equivalent based on the EUR/US$ exchange rate as of the settlement of the tender offers.

The offers will only be opened for acceptances once the French stock exchange authority, the Autorite des marches financiers (AMF), and the French Finance Ministry have granted their respective clearances. The offers will be subject to the following conditions: (i) Business Objects securities tendered in the offers represent at least 50.01 % of all voting rights on a fully diluted basis and (ii) receipt of EU and US antitrust approvals.

The complete offer documents in accordance with French and US law will be submitted, together with further details of the offer, to the French financial services authority, Autorite des marches financiers (AMF), and the US Securities and Exchange Commission (SEC).

Goldman Sachs acts as financial advisor to Business Objects; Deutsche Bank Securities Inc. acts as financial advisor to SAP.

Additional Information

The tender offer for the outstanding ordinary shares, the Convertible Bonds and the warrants of Business Objects has not yet commenced. This press release is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any Business Objects securities. The solicitation and the offer to buy ordinary shares of Business Objects, the Convertible Bonds and the warrants will be made only pursuant to an offer to purchase and related materials that SAP and its subsidiary intend to file with the SEC on Schedule TO. Business Objects also intends to file a solicitation/recommendation statement on Schedule 14D-9 with respect to the tender offer.

Business Objects stockholders and other investors should read the Tender Offer Statement on Schedule TO, the Schedule 14D-9 as well as the Note d'Information and the Note en Reponse to be filed by SAP carefully because these documents will contain important information, including the terms and conditions of the tender offer.

Business Objects stockholders and other investors will be able to obtain copies of these tender offer materials and any other documents filed with the AMF from the AMF's website (amf-france.org) or with the SEC at the SEC's website at www.sec.gov, in both cases without charge. Materials filed by SAP may be obtained for free at SAP's web site, www.sap.com. Materials filed by Business Objects may be obtained for free at Business Objects' web site, www.businessobjects.com.

Stockholders and other investors are urged to read carefully all tender offer materials prior to making any decisions with respect to the tender offer.

Press Conferences in Frankfurt and Paris

SAP and Business Objects senior management will host parallel joint press conferences in two locations to discuss the transaction:

in Frankfurt on Monday, October 8th at 3pm CET, 9am EST, and 6am PST (location: Japan-Center, Conference Center, 1st floor, Taunustor 2, 60311 Frankfurt am Main, Germany, http://www.taunustor.de/); dial in number: +1 480 629-9564 (US), +44 207 190 1596 (UK), +49 695 8999 0701 (Germany). Replay number: +1 303 590-3030 (US), +44 207 154 2833 (UK); Replay passcode: 3792655. The Frankfurt press conference will be webcast at www.sap.com/press,

in Paris on Monday, October 8th at 3pm CET, 9am EST, and 6am PST (location: Hotel de Meurice, Paris); dial in number: +1 334 323 6201 (US), +44 207 162 0025 (UK), +33 17099 3208 (France). The Paris press conference will be webcast at http://wcc.webeventservices.com/view/wl/r.htm?e=95765&s=1&k=7CFDD62292014C7EA5B7220DD5D79C66&cb=genesys

Investor and Financial Analyst Conference Call

The press conferences will be followed by a joint investor and financial analyst conference call at 4 pm CET, 10 am EST and 7 am PST (Dial in number: +1 480 293-1744 (US), +44 207 190 1232 (UK), +49 695 8999 0706 (Germany)). Replay number: +1 303 590-3030 (US), +44 207 154 2833 (UK), Replay passcode: 3792656.

The financial analyst conference call will be webcast at www.sap.com/investor

About SAP

SAP is the world's leading provider of business software*. More than 41,200 customers in more than 120 countries run SAP® applications-from distinct solutions addressing the needs of small and midsize enterprises to suite offerings for global organizations. Powered by the SAP NetWeaver® platform to drive innovation and enable business change, SAP software helps enterprises of all sizes around the world improve customer relationships, enhance partner collaboration and create efficiencies across their supply chains and business operations. SAP solution portfolios support the unique business processes of more than 25 industries, including high tech, retail, financial services, healthcare and the public sector. With subsidiaries in more than 50 countries, the company is listed on several exchanges, including the Frankfurt stock exchange and NYSE under the symbol "SAP." (Additional information at http://www.sap.com)

About Business Objects

Business Objects has been a pioneer in business intelligence (BI) since the dawn of the category. Today, as the world's leading BI software company, Business Objects transforms the way the world works through intelligent information. The company helps illuminate understanding and decision-making at more than 44,000 organizations around the globe. Through a combination of innovative technology, global consulting and education services, and the industry's strongest and most diverse partner network, Business Objects enables companies of all sizes to make transformative business decisions based on intelligent, accurate, and timely information. Business Objects has dual headquarters in San Jose, Calif., and Paris, France. The company's stock is traded on both the Nasdaq (BOBJ) and Euronext Paris (ISIN: FR0004026250 - BOB) stock exchanges. More information about Business Objects can be found at www.businessobjects.com.

Forward-Looking Statements

This release contains forward-looking statements that involve risks and uncertainties concerning the parties' ability to close the transaction and the expected closing date of the transaction, the anticipated recommendation by the Business Objects Board of the transaction to shareholders, the anticipated benefits and synergies of the proposed transaction, anticipated future combined operations, products and services, and the anticipated role of Business Objects, its key executives and its employees within SAP following the closing of the transaction. Actual events or results may differ materially from those described in this release due to a number of risks and uncertainties. These potential risks and uncertainties include, among others, the outcome of regulatory reviews of the proposed transaction, the ability of the parties to complete the transaction (including SAP's ability to tender successfully for at least 50.01% of all voting rights on a fully diluted basis), the impact on minority shareholders who do not tender into the offer, the failure to retain key Business Objects employees, customer and partner uncertainty regarding the anticipated benefits of the transaction, the failure of SAP and Business Objects to achieve the anticipated synergies of the proposed transaction and other risks detailed in Business Objects' SEC filings, including those discussed in Business Objects' quarterly report on Form 10-Q for the quarter ended June 30, 2007, which is on file with the SEC and available at the SEC's website at www.sec.gov. Business Objects is not obligated to update these forward-looking statements to reflect events or circumstances after the date of this document.

Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "believe," "estimate," "expect," "forecast," "intend," "may," "plan," "project," "predict," "should" and "will" and similar expressions as they relate to SAP are intended to identify such forward-looking statements. SAP undertakes no obligation to publicly update or revise any forward-looking statements. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations. The factors that could affect SAP's future financial results are discussed more fully in SAP's filings with the U.S. Securities and Exchange Commission ("SEC"), including SAP's most recent Annual Report on Form 20-F filed with the SEC. Statements regarding the expected date of closing of the tender offer, and expected integration, growth and improved customer service benefits are forward-looking statements and are subject to risks and uncertainties including among others: uncertainties as to the timing of the tender offer, the satisfaction of closing conditions, including the receipt of regulatory approvals, whether certain industry segments will grow as anticipated, the competitive environment among providers of software solutions, and difficulties encountered in integrating companies and technologies. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "believe," "estimate," "expect," "forecast," "intend," "may," "plan," "project," "predict," "should" and "will" and similar expressions as they relate to SAP are intended to identify such forward-looking statements. SAP undertakes no obligation to publicly update or revise any forward-looking statements. All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from expectations The factors that could affect SAP's future financial results are discussed more fully in SAP's filings with the U.S. Securities and Exchange Commission ("SEC"), including SAP's most recent Annual Report on Form 20-F filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

For more information, press only:

Herbert Heitmann, SAP, +49 (6227) 7-61137, herbert.heitmann@sap.com, CET

Christoph Liedtke, SAP, +49 6227 7-50383, christoph.liedtke@sap.com, CET

Frank Hartmann, SAP, +49 (6227) 7-42548, f.hartmann@sap.com, CET

Marge Breya, Business Objects, +1 408 953-6092, marge.breya@businessobjects.com, PST

Philippe Laguerre, Business Objects, +1 33 (1) 41 25 38 15, plaguerre@businessobjects.com, EST

For more information, financial analysts only:

Stefan Gruber, SAP, +49 (6227) 7-44872, investor@sap.com, CET

Martin Cohen, SAP, +1 (212) 653-9619, investor@sap.com, EST

Edouard Lasalle, Business Objects, +33 (1) 41 25 24 33, edouard.lassalle@businessobjects.com, CET

Nina Camara, Business Objects, +1 (408) 953-6138, nina.camara@businessobjects.com, PST

Note to Editors

Broadcast-standard video content about SAP is available at www.thenewsmarket.com/sap. Registration on the site and video is free to the media.

(*) SAP defines business software as comprising enterprise resource planning and related applications such as supply chain management, customer relationship management, product life-cycle management and supplier relationship management.

SAP, R/3, mySAP, mySAP.com, xApps, xApp, SAP NetWeaver and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP AG in Germany and in several other countries all over the world. All other product and service names mentioned are the trademarks of their respective companies. Data contained in this document serve informational purposes only. National product specifications may vary.

Source: SAP AG

Wednesday, September 26, 2007

SAP launches Business Process Expert Community for Corporate Performance Management (CPM)!

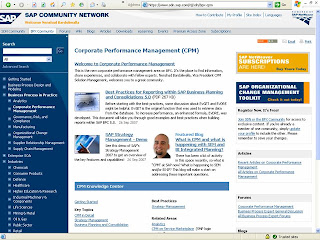

Welcome to the new Corporate Performance Management area on BPX at https://www.sdn.sap.com/irj/sdn/bpx-cpm! SAP has made significant recent investments in the Corporate Performance Management space with our acquisitions of Pilot Software and OutlookSoft and reseller agreement with Acorn Systems, and interest in these solutions is exploding. With these moves, it was crucial for us to develop an open community for everyone to participate, and the BPX Community for Corporate Performance Management is open in more ways than one. It is open to those offering new ideas on product deployment, new developments, and innovations and it is open to those looking for new answers to their questions. It doesn’t matter if you are a customer, partner, or an SAP employee, you can find a wealth of information here: tips and tricks, demos, FAQs, how-to-guides, and collaborative forums. We provide the platform, but the community belongs to YOU and is for YOU to shape and make your own.

With this in mind, I would like to invite you to send your ideas, tell us your opinions, and share your practical experience to make this the most vibrant on-line community of CPM practitioners in the world. It's easy to submit your articles or write blogs for this area, too! While those of us from SAP will be frequently contributing to this site, ultimately, it is YOU who can provide the most value to your fellow BPX community members based on YOUR experience. If you need help, or have suggestions for improving this area, please do not hesitate to contact us and we will be more than happy to assist you!

I am certain that you will find this to be a valuable resource and look forward to working with all of you to make the CPM area in BPX and the corresponding forums both vibrant and successful!

Best Regards,

Nenshad Bardoliwalla

Vice President Solution Management

Corporate Performance Management Products

Thursday, August 02, 2007

Informatica Strikes OEM Agreement With SAP AG

Our market research has proven that companies increasingly rely on SAP NetWeaver as the integration platform even across highly heterogeneous environments. For example, today there are already 70% of SAP NetWeaver BI customers integrating between 25% - 40% of non-SAP data, in many cases even up to 70% of the data being sourced outside of SAP systems. That being said, there are a lot of innovations that a company dedicated to data integration with a track record of excellence can really add that augment our core capabilities. Therefore, we are really happy to announce this partnership with Informatica, who has always provided fantastic data integration capabilities and has long been recognized as a market leader in this space. The added capabilities will further the flexibility for data integration while considerably lowering cost of integration, specifically in the case of integration of heterogeneous information infrastructures.

With a combination of our existing BI technology with tens of thousands of installations, new innovations like Business Intelligence Accelerator, and key capabilities being augmented by market-leading partners like Informatica, I am certain we will continue to observe the dramatic uptick in customer deployments that we are seeing today.

You can read the press release below:

Informatica Strikes OEM Agreement With SAP AG

Leading Enterprise Software Vendor Will Embed Cornerstone Informatica Products Into Key Software Offerings

REDWOOD CITY, Calif., July 23, 2007—Informatica Corporation (NASDAQ: INFA), a leading provider of data integration software, today announced that it has entered into an OEM relationship with SAP AG (NYSE:SAP), the world's leading provider of business software.

Under the terms of this OEM agreement, SAP will embed Informatica's market-leading PowerCenter, PowerExchange and Metadata Manager software into SAP® performance management and analytic applications and the SAP NetWeaver® platform for master data management and business intelligence. By incorporating Informatica's products into its applications, SAP will now be able to offer customers the ability to better integrate and track data from non-SAP, third-party and legacy systems.

"With the continually increasing fragmentation of corporate data, there is more need than ever before to integrate, transform and manage corporate information effectively," said Paul Hoffman, executive vice president, Informatica Corp. "Our OEM relationship with SAP will help ensure that customers have access to Informatica's best-in-class software to connect their business data – regardless of the source – into their SAP business applications."

"This agreement with Informatica will enhance and extend SAP's business solutions and allow our customers to access this best-in-class technology to further SAP's goal: driving unparalleled visibility and management across an enterprise," said Nimish Mehta, senior vice president, Enterprise Information Management, SAP. "With this agreement, both our existing and new customers will benefit as Informatica and SAP work closely together to deliver world-class enterprise software to an ever-increasing customer base."

Sunday, July 22, 2007

Webcast Alert - Tom Davenport and Nenshad Bardoliwalla on Optimizing Corporate Performance for Competitive Advantage

Webcast Details

Optimizing Corporate Performance for Competitive Advantage

Date: Wednesday July 25, 2007 Add to Outlook

Time: 1:00 PM ET Convert to your timezone

Speakers include:

Nenshad Bardoliwalla, Vice President, Corporate Performance Management Solution Management, SAP

Tom Davenport, Author

As most leading companies seek to drive maximized corporate performance by applying greater analytical rigor to their business processes, performance gaps are being minimized, if not eliminated, allowing companies to fully capitalize on the value of the cross section of their internal and market information. At times, the breakdown of their faulty decisions can be attributed to faulty data and data assumptions, poor communication and collaboration -- therefore, performance gaps are now under siege as leading edge companies adopt broad capabilities for enterprise-level business analytics and intelligence.

Join thought leader and author Tom Davenport and VP of Solution Management for Corporate Performance Management products at SAP, Nenshad Bardoliwalla, for an interactive discussion on best practices and approaches that are driving agility and competitive advantage in organizations today.

In this one-hour event you will hear how to:

• Start an iterative corporate performance management initiative

• Formulate a base line from which to define corporate goals

• Drive adoption of corporate goals throughout the organization

• Ensure plans and budgets are linked to strategic goals

• Provide information to any stakeholder in time and context

• Provide management and statutory reporting

Saturday, June 30, 2007

SAP acquires OutlookSoft and launches the Next-Generation of Corporate Performance Management solutions

In future posts, I will hopefully have the chance to articulate the overarching principles of our Office the CFO strategy and how our Corporate Performance Management strategy supports this, but those of you who are interested, you can watch the presentation given by Adam Thier and myself at SAPPHIRE Vienna 2007, which spells it out in great detail. As I had the chance to lead our due diligence of OutlookSoft, I want to take this opportunity to point out what we saw in OutlookSoft that made it so compelling for SAP and our customers.

The first aspect of OutlookSoft that we found compelling was unification. The entire performance management experience is driven by the same metaphors and metadata, regardless of whether or not one is conducting planning, budgeting, and forecasting, legal or management consolidation, or building financial reports. For ALL of these processes, the dimensional model is the SAME. The business rules are the SAME. The user-experience is the SAME. This dramatically reduces the TCO of the solution and makes it much simpler to design performance management processes that span the entire value chain of an organization, and not make customers pay a penalty if they want to expand beyond planning to management consolidation to financial reporting.

This is in stark contrast to the offerings of our competitors, like Oracle's Hyperion System 9, for example, which is a patchwork of dozens of acquisitions that are almost completely unintegrated across the same set of processes. The only thing integrated about System 9 is the fact that you you can get all of this disparate technology on the same DVD. Ok, that's not entirely true, it does share "common security" and a "common installer", which a few customers probably find compelling. When you use Hyperion Planning, it relies on the ancient and soon-to-be legacy technology of Essbase, a proprietary, decade-old multidimensional engine that has severe scalability issues due to its inability to handle sparse data and time-consuming cube recalculation times. Do you want to write a formatted financial report off of your Hyperion Planning data? You need Hyperion Financial Reporting. Do you want to slice and dice your Hyperion Planning data? You need Hyperion Web Analysis. Contrast this with OutlookSoft, where the EXACT SAME APPLICATION is used for financial reporting, slice-and-dice, and planning, with none of the hassles of having multiple reporting applications and legacy multidimensional databases to maintain.

And don't even THINK you can get any economies of scale by introducing consolidation capabilities into your existing Hyperion Planning landscape. For that, Hyperion licenses a SEPARATE application, Hyperion Financial Management, which is COMPLETELY DIFFERENT from Hyperion Planning. Same database? Nope. Same metadata? Nope. Same dimensional structure? Nope. Sames business rules definition? Nope. Want to bring together your actual and plan data? You do the same thing with Hyperion's own applications as you would do to port data between two applications from completely separate vendors: you move the data over using a flat file! Contrast this with OutlookSoft, where the EXACT SAME APPLICATION is used for consolidation, with the same database, same metadata, same dimensional structure, same business rules, etc. with none of the hassles of having multiple reporting applications and legacy multidimensional databases to maintain.

Now, to be fair, Oracle has proven itself astute in reconciling its large technology assets before, and that is likely to be true here as well. So Hyperion's mediocre BI tools, like Web Analysis, Financial Reporting, Interactive Reporting, and Production Reporting, that are crucial to extracting any value out of their disparate applications are almost certainly not going to live very long. With the Siebel acquisition, Oracle declared that Siebel Analytics would become the de facto BI offering (although I still don't think the Discoverer and Daily Business Intelligence teams have seen the memo yet), and this offering was re-christened Oracle BI EE 10g. And what does that mean for Hyperion's customers? It means that Hyperion customers can look forward to having to replace all of the Business Intelligence investments they made with the Hyperion tools and migrate to the Oracle BI EE 10g tools, and having yet another set of metadata, business logic, and architectural headaches to worry about. But that's not the worst of it. It has never been a secret that Oracle's database team has held the development power within the company, and they have invested a lot of energy into building up the Analytic Workspaces for multidimensional functionality within the most recent versions of the database. Given the fact that the database team rules the roost and is one of the only area of the company besides the M&A group that is still trying to innovate after Oracle's decision to turn from software company into technology holding company, it would be very surprising to see Essbase live more than a year or two, which means that Hyperion customers can also look forward to a forced migration to Oracle's Analytic Workspaces technology. After all, Oracle may provide"Applications Unlimited", but they never said anything about "Middleware Unlimited", so there is no guarantee about the life of acquired middleware products, and inexplicably, Hyperion is part of the middleware group at Oracle. I don't know about you, but any company that thinks the same group that develops the java application server should also be responsible for statutory consolidation capabilities for IFRS probably doesn't understand CPM that well. But I digress. This blog is about OutlookSoft and SAP, and why OutlookSoft's unification is so valuable for customers. That should be readily apparent now.

Another aspect of OutlookSoft that customers find incredibly compelling is its very strong usability. In looking at every CPM vendors offerings, we found that OutlookSoft far and away had the most usable applications, with powerful, patented functionality that could really extract the full value of Microsoft Office, well beyond what anyone else had been able to accomplish in the industry. With OutlookSoft, end-users can leverage their entire skill set with Microsoft Excel without having to suffer from the constraints of other vendors add-ins. ALL formatting, formula operations, and commentary, etc. capabilities can be used in Excel, while still maintaining the value proposition of a centralized performance management environment on a common database. Every other tool in the market is either "Excel-like" or "Excel-lite", placing unnecessary constraints on the users that frustrate them to no end. What's the point of giving end-users the appearance of Excel when they can't use the full power of the solution?

At this point, Oracle probably has 10-15 Excel front-end clients, many of which they acquired from Hyperion. Essbase had an Excel-client (historically one of the best in the industry), HFM had one, Hyperion Planning had one, and other applications had them as well. For many years, these multiple Excel clients didn't even work with each other. The idea then to unify all of these Excel-clients manifested itself with SmartView, which came out a couple of years ago. SmartView was a great idea, since there would finally be one Excel client for all Hyperion applications. It only had one problem: it provided the lowest common denominator of functionality across all the individual Excel plug-ins. Much of the power of the Essbase Excel add-in could not be achieved, so customers were left in a lurch. Of course, now things should be much easier for Oracle customers, since Oracle BI EE 10g, which will become the BI tool of choice for Hyperion applications, also has its own lousy Excel add-in. In stark contrast, as mentioned before, OutlookSoft has one Excel add-in, and it's way better than anything else out there.

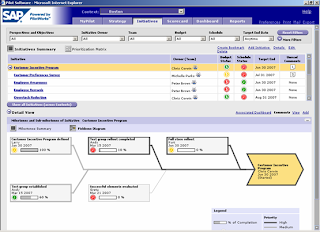

A third aspect of OutlookSoft that is incredibly compelling is the notion of business process flows. While the dinosaur, monolithic architectures of previous generations of performance management solutions have enforced process siloes, what companies really want is the ability to manage the entire performance management cycle holistically in a process framework. OutlookSoft allows you to do exactly that. With prepackaged Business Process Flows for monthly budgeting, management consolidation, legal consolidation, CapEx planning, Workforce Planning, etc., the entire set of roles, dimensional entities, input schedules, etc. are all packaged together and can be orchestrated across the entire organization. Financial analysts can see exactly where the organization is in terms of who is in what step of a process, and end-users know exactly where they came from, where they are, and where they have to go next in the performance management process. This is a huge differentiator and something that none of our competitors do. Hyperion has been talking about adding comprehensive, suite-wide workflow capabilities to its disjointed collection of applications for years, but so far, it's still talk.

Finally, because OutlookSoft did not have to invest in stapling a large portfolio of mediocre, acquired products together, they were able to invest heavily in modern technology like Service Oriented Architecture to provide a high degree of flexibility and interoperability with other applications. For example, in the Business Process Flows capability of OutlookSoft, ANY web service that has a standard interface exposed by a WSDL can be consumed so that end-users can stitch together composite application processes using standards-based technology. Contrast this with the architectures of our competitors, who still use CORBA and decade-old MOLAP technologies as their underlying architectures and you can understand very quickly why our technology is vastly superior.

Of course, technology for its own sake has little value when it comes to business applications, and it is clear that OutlookSoft's architecture confers upon customers huge business advantages. With OutlookSoft's SOA approach, business processes can be reconfigured on the fly by taking advantage of the underlying application services available to give customers the agility they need in an environment that changes on a dime. By avoiding a pure reliance on legacy MOLAP technology, OutlookSoft can aggregate information from any level of a dimensional hierarchy, so you can see the impact of changes to your models made deep at the leaf level in the application reflected at a much higher aggregate level without having to go through the expensive and time-consuming process of recalculating cubes.

But OutlookSoft is only the end of the first chapter of our story. As we combine it with the deep profitability modeling capabilities provided by Acorn and the visionary strategy management capabilities of Pilot, and then intertwine it with the Governance, Risk, and Compliance functionality that SAP has pioneered, the end-results far surpass the depth and breadth of both vision and functionality of any other CPM vendors in the space. When combined with SAP's Business Process Platform, defined as the combination of the deep application functionality provided by our market-leading Business Suite and the enterprise class technology backbone of SAP NetWeaver, we will be the only vendor in the industry to offer BOTH the empowerment and flexibility that finance end-users need for performance management along with the enterprise class backbone that IT organizations have come to rely on.

The Next Generation of Corporate Performance Management solutions for the Finance Professional of 2010 is here. Judging from the response of our customers and more interestingly, that of our competitor's customers, it is clear that they recognize the value, innovation, and vision of what SAP is delivering, and this is only the beginning! Please contact me to learn more.

Tuesday, February 20, 2007

SAP brings strategy to everyone - "Web 2.0" style

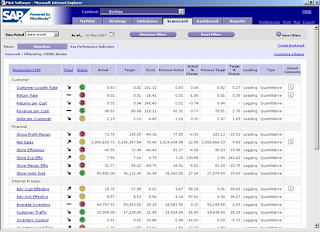

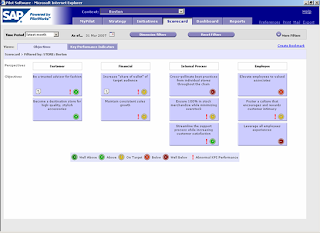

A picture says a thousand words, so I thought I would begin my post with one. It's official, SAP acquired Pilot Software last week, and you can read the press release here: SAP Strengthens Leadership in Analytic Applications Market with Acquisition of Pilot Software. Pilot's flagship application, PilotWorks, is highly interactive and has the visually engaging user experience you see above and below:

So what does PilotWorks do? It's an integrated system for delivering the goals, metrics, and initiatives to every person in an organization to help align them to the overall strategy. What we loved about the application as we got to know it better is how incredibly flexible it is. It is completely methodology agnostic. If you want to use the Kaplan and Norton Balanced Scorecard methodology, you can, but any of a number of other performance management methodologies are supported as well.